raleigh nc sales tax calculator

Raleigh North Carolina and Winston-Salem North Carolina. Nearby homes similar to 9108 Wooden Rd have recently sold between 385K to 520K at an average of 235 per square foot.

![]()

Georgia New Car Sales Tax Calculator

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in North.

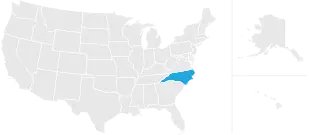

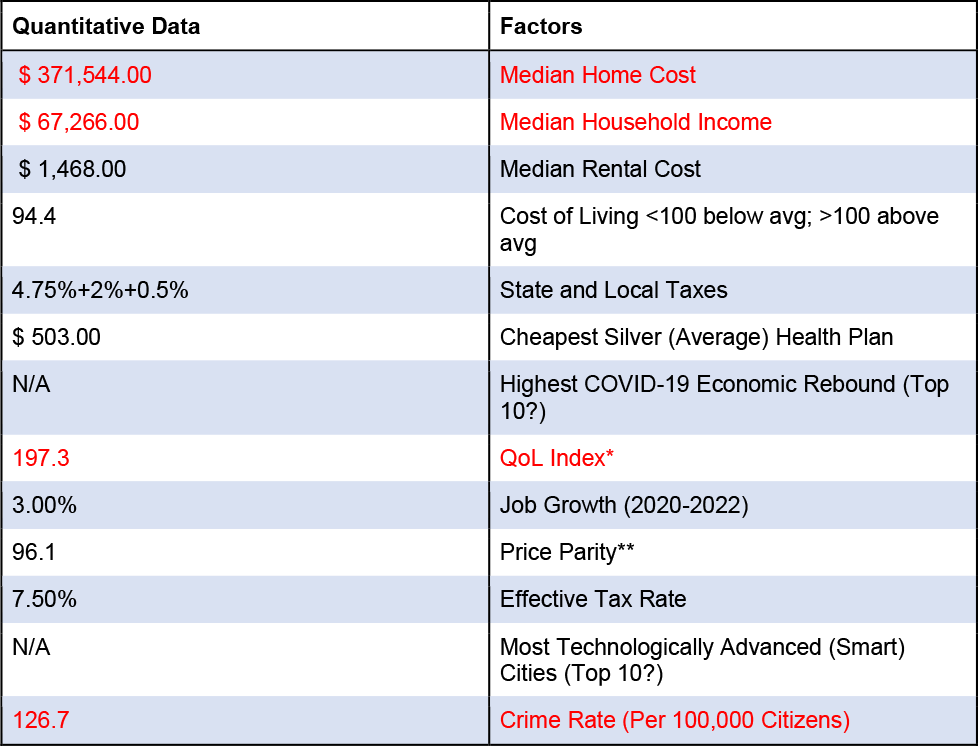

. General sales and use tax. This takes into account the rates on the. Our Premium Cost of Living Calculator includes State and Local Income Taxes.

2022 Cost of Living Calculator for Taxes. The December 2020 total local sales tax rate was also 7250. With local taxes the total sales tax rate is between 6750 and 7500.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Our Premium Cost of Living Calculator includes State and Local Income Taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Combined with the state sales tax the highest sales tax rate in North Carolina is 75 in. In addition to that statewide rate every county in North Carolina collects a separate sales tax which ranges from 2 to 225. 2022 Cost of Living Calculator for Taxes.

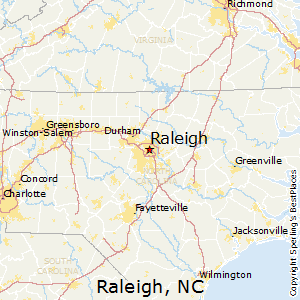

This is the total of state county and city sales tax rates. West Raleigh NC Sales Tax Rate The current total local sales tax rate in West Raleigh NC is 7250. The North Carolina sales tax rate is currently.

2022 Cost of Living Calculator for Taxes. Please note that we can only estimate your. Raleigh NC Sales Tax Rate The current total local sales tax rate in Raleigh NC is 7250.

Raleigh North Carolina and Savannah Georgia. In fact the whole Triangle area will be. North Carolina has a 475 statewide sales tax rate.

Putting everything together the average cumulative sales tax rate in the state of North Carolina is 697 with a range that spans from 675 to 75. As far as all cities towns and locations go the. Please note that we can only estimate your.

Thank you for printing this page from the City of Raleighs Official Website wwwraleighncgov 06102022 819 am Sales Tax. The minimum combined 2022 sales tax rate for Raleigh North Carolina is. North Carolina NC Sales Tax Rates by City R The state sales tax rate in North Carolina is 4750.

The base sales tax in North Carolina is 475. When you give Liberty Tax the honor of preparing your taxes youre choosing to. Multiply the vehicle price after any trade-ins but.

In North Carolina it will always be at 3. The most populous location in Wake County North Carolina is Raleigh. 025 lower than the maximum sales tax in NC.

Raleigh North Carolina and Chapel Hill North Carolina. General sales and use tax. 427000 Last Sold Price.

NC Rates Sales Tax Calculator Sales Tax Table. The December 2020 total local sales tax rate was also 7250. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local.

The average cumulative sales tax rate between all of them is 725. The 725 sales tax rate in Raleigh consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. SOLD MAY 16 2022.

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

![]()

Prepared Food Beverage Tax Wake County Government

Durham County 2008 Property Taxes How Much Does It Cost To Live In Durham Nc

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

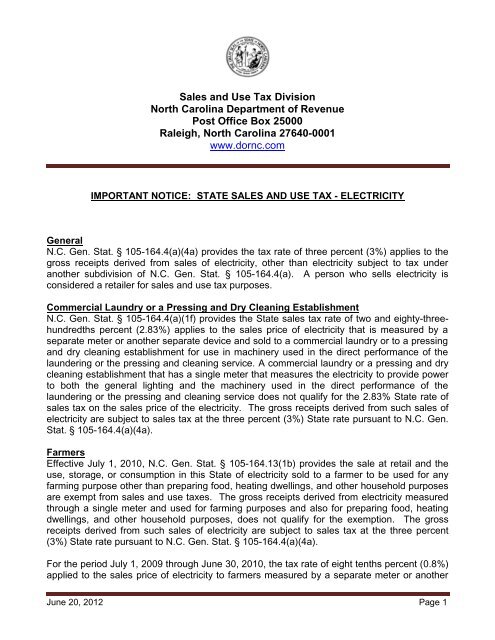

Sales And Use Tax Division North Carolina Department Of Revenue

The Ultimate Guide To North Carolina Property Taxes

Covid 19 Sales Tax Updates By State Taxconnex

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Top 10 Cities For Financial Independence In 2022 Choosefi

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Sales And Use Tax On Electricity Nc Department Of Revenue

Economy In Raleigh North Carolina

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners